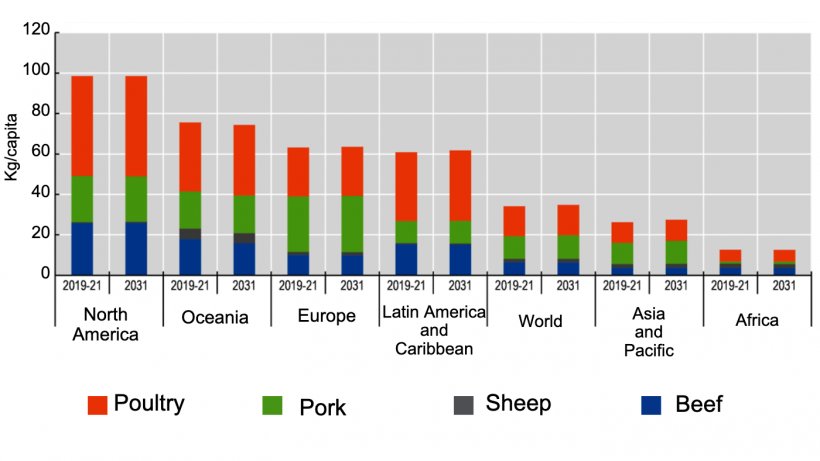

Global pig meat consumption is projected to increase to 129 Mt over the next ten years and to account for a third of the total increase in meat consumption. However, on a per capita basis, global consumption is expected to stagnate over the outlook period. Pork will remain the meat most eaten in the European Union over the coming decade, even though it will remain stable in per capita terms as changes in diets will favour poultry as a cheaper and perceived better food choice. In most of Latin America, favourable relative prices have positioned pork and poultry as the favoured meats to meet rising demand from the middle class. Several Asian countries which traditionally consume pork such as Korea and Vietnam, are also projected to increase consumption on a per capita basis.

Pig meat output is projected to rise by 17% by 2031, up from an ASF-reduced base level 2019-2021 and benefiting from increasing specialisation of the sector and biosecurity measures. The ASF outbreak across Asia, starting in late 2018, will continue to affect many countries in the early years of the outlook period, with China, the Philippines and Vietnam experiencing the greatest impact. It is projected that ASF outbreaks will continue to keep global pig meat output below previous peak levels until 2022, after which it is expected to steadily increase to 2031.

Pig meat production in China is expected to continue to increase and attain pre-ASF (2017) levels by 2023. Most of the pig meat production increase in ASF-affected regions will be due to conversion from largely small-scale backyard holdings to large-scale commercial enterprises. Vietnam, which has suffered from ASF-reduced output since 2019, is projected to become the sixth largest pig meat producer just below Brazil and Russia. Vietnamese production is projected to recover to 2019 levels by 2023 and to grow further over the projection period.

Pig meat production in the European Union is projected to decline as environmental and animal welfare concerns are expected to limit domestic demand while the decline in imports by China also weighs negatively on trade prospects. Brazil and US production are also expected to fall at the start of the Outlook in the face of the expected decline of Chinese import demand and high feed costs. On the other hand, their production will remain high given their strong competitive position in global markets.

June 29, 2022/ Economic Co-operation and Development.

https://www.oecd-ilibrary.org